How can we help you?

We invite you to get in touch via a free, no-obligation initial consultation.

The Treasury is exploring a fundamental change to how we tax homes: scrapping buyer‑paid Stamp Duty Land Tax (SDLT) on owner‑occupied purchases and replacing it with either a seller levy (kicking in from £500k) and/or an annual property charge on homes valued above £500k. Nothing is final, but this is now an active policy track.

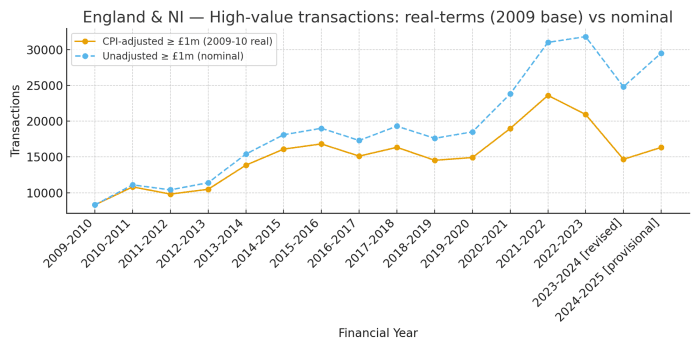

Activity is soft but not broken. Our high‑value transaction analysis (England & NI, transaction volumes for £1m+) — including CPI/HPI‑adjusted series back to 2009–10, shows nominal volumes peaking post‑pandemic, then cooling with higher rates, and stabilising more recently (HMRC). That fits the broader receipts picture: SDLT receipts fell notably in 2023–24 versus 2022–23 as transactions slowed — underscoring why the Treasury is reassessing the base.

Interpretation: removing buyer SDLT would reduce an upfront cash friction; whether overall liquidity improves depends on the design of what replaces it.

CPI = Consumer Price Index

HPI = House Price Inflation

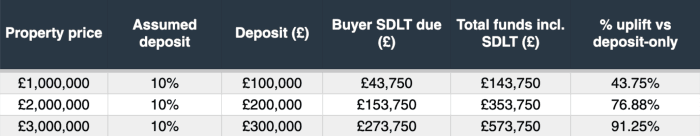

With the current main‑residence bands (0% to £125k, 2% to £250k, 5% to £925k, 10% to £1.5m, 12% above), the cheques become material exactly where many family homes transact, especially in London and the South East.

Assumptions: standard main‑residence SDLT (no surcharge), deposit fixed at 10%.

Source: HMRC

Buyer friction reduces if SDLT is removed at purchase.

But new frictions can appear:

Bottom line: in its current briefed form, the package reads more like a revenue boosting opportunity for the treasury than a pure liquidity reform. Liquidity can still improve, but only with careful design.

If you would like to discuss your mortgage options with a qualified professional, you can speak to one of our mortgage advisors on 0800 980 8777, by emailing us at info@privatefinance.co.uk

Disclaimer: This note is for information only and does not constitute tax advice. Always seek professional advice specific to your circumstances. The views and opinions expressed in this content are those of the author and do not constitute financial, legal, or professional advice, nor should they be interpreted as a recommendation. They do not necessarily reflect the official views, policies, or positions of Private Finance, and are not intended to represent broader market or industry perspectives.