How can we help you?

We invite you to get in touch via a free, no-obligation initial consultation.

Freedom‑of‑Information data obtained by Quilter show 30,338 borrowers aged 36 + opted for terms of 35 years or longer in 2024, compared with just 8,629 in 2019—a 251 % jump. The sharpest annual rise came in 2021 as higher rates squeezed affordability. By contrast, 31‑ to 35‑year‑olds increased long‑term borrowing by a more modest 56 % over the same five‑year window.

Our take: Stretching the term beyond state‑pension age has become the favoured affordability lever now that median two‑year fixes still hover around 4.4 %. Lenders with generous age‑at‑term‑end policies (75–85) are poised to capture this business, but advisers should build robust exit plans—regular overpayments, downsizing options or pension‑linked repayment strategies to avoid storing up later‑life risks.

Source: Mortgage Solutions

Rightmove’s July House Price Index shows the average asking price fell 1.2 % to £373,709, the largest July drop since records began in late 2021. London led the retreat (‑1.5 %, with Inner London at ‑2.1 %), while the North East bucked the trend with a 1.2 % rise. Despite the softer pricing, buyer activity remains firm: sales agreed are 5 % higher and buyer enquiries 6 % higher than a year ago. In response, Rightmove has cut its 2025 price‑growth forecast from +4 % to +2 %.

Our take: With stock at decade highs, motivated sellers are pricing keenly—giving buyers room to negotiate but prompting valuers to tighten high‑LTV assumptions outside buoyant regions like the North East. Build in a contingency on purchase cases pushing 90–95 % LTV over the summer.

Source: Rightmove

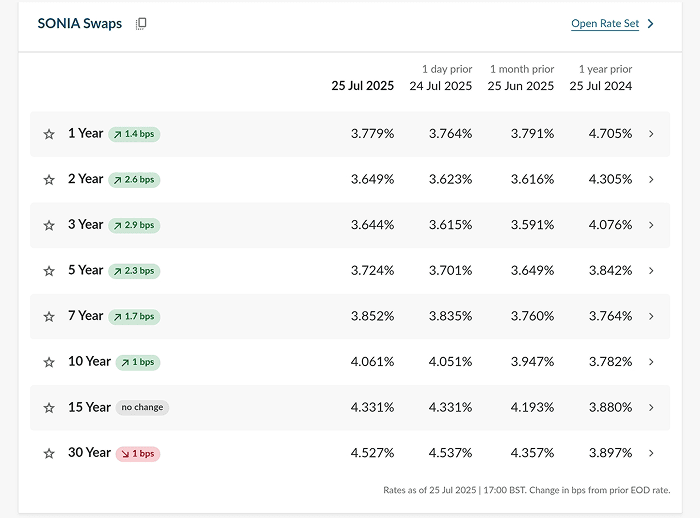

Funding costs edge higher at the longer end

Source: Chatham Financial

This article is based on information available on the date of issue, 28th July 2025.

Disclaimer: The views and opinions expressed in this content are those of the author and do not constitute financial, legal, or professional advice, nor should they be interpreted as a recommendation. They do not necessarily reflect the official views, policies, or positions of Private Finance, and are not intended to represent broader market or industry perspectives.