- Mortgages

- Residential

- Specialist

- Buy-to-Let

- Commercial

- Mortgages by Profession

- Review your Mortgage

- Mortgage Adviser Appointment

- Insurance

- Tools & Resources

- About PF

- Contact Us

Work out how much your monthly mortgage payments could be with our easy-to-use repayment calculator.

Of course, if you want us to work it all out for you, just request a call back or call us now and one of our consultants will be happy to help you.

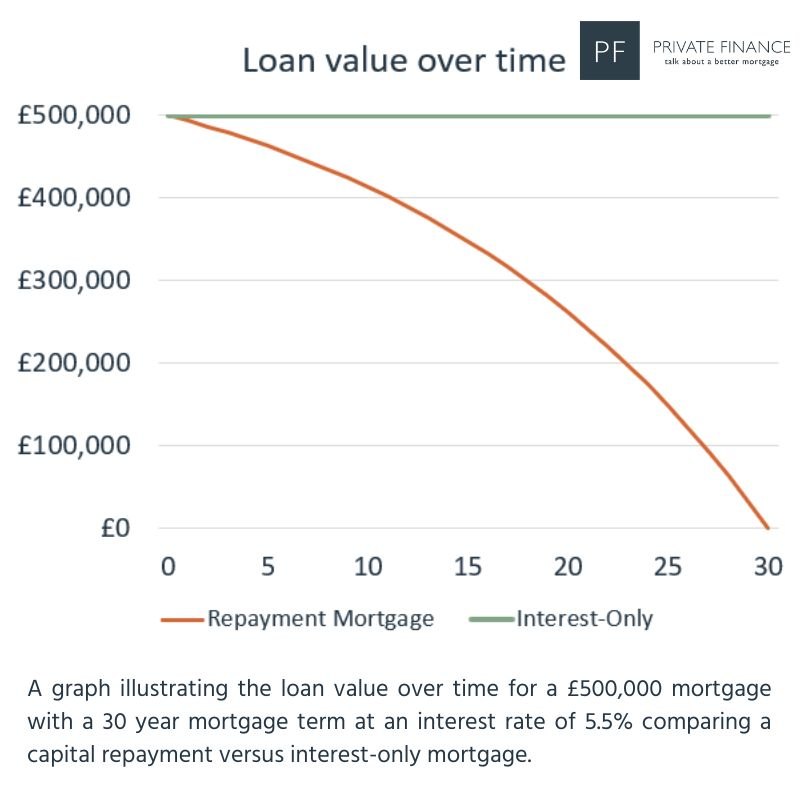

The ‘loan value over time’ illustration explains how your loan value changes over the mortgage term.

In this example, the loan value over time is illustrated for a £500,000 mortgage with a 30 year mortgage term at an interest rate of 5.5%. If opting for a capital repayment mortgage, the individual would have repaid the full balance of the mortgage at the end of the 30 year mortgage term. However, if they had opted for a full interest-only mortgage, the full balance of £500,000 is due to be repaid at the end of the 30 year term.

In each year of the mortgage term, the principal payment is subtracted from the starting balance. This calculates the end balance for that year of the mortgage term. For a full repayment mortgage, the balance is fully paid by the term’s end.

With an interest-only mortgage, or if part of the mortgage is interest-only, known as a part and part mortgage, the interest portion remains due at the end of the mortgage term. The interest payments are not subtracted from the mortgage balance.

Please note the information provided by this mortgage repayment calculator serves as a guide only and should not be relied on as a recommendation or advice that any particular mortgage is suitable for you. All mortgages are subject to the applicant(s) meeting the eligibility criteria of lenders.

While our mortgage calculators offer valuable insights into what could be achievable, they do not provide the full picture. To receive tailored mortgage advice suitable for your unique needs and circumstances, and to explore a wider array of mortgage products, schedule an appointment with us or call an expert now.

Repayment Mortgage

A repayment mortgage, also known as a capital and interest mortgage, is the most popular option amongst borrowers for residential property. The mortgage repayments are made up of a capital payment used to repay the initial capital borrowed and some interest.

Interest-Only Mortgage Calculation

The monthly repayments only pay off the interest of the loan and not the initial capital borrowed. At the end of the mortgage term, the full mortgage amount will have to be repaid.

Part and Part Mortgage

A part and part mortgage offers a combination of both a repayment mortgage and an interest-only mortgage.

There are myriad variables which impact what interest rate you can get on your mortgage. To get a better idea of what mortgage rate you will be able to achieve, it is best to speak with an expert mortgage adviser who can guide you in the context of your financial and personal circumstances.

A higher interest rate would increase your mortgage repayments, provided all other factors remain consistent. At the same time, a lower interest rate would result in lower monthly mortgage repayments.

For an idea of how rising interest rates might affect your mortgage, input the new interest rate into our calculator above. Compare the resulting mortgage repayments against those at a lower rate. If you are concerned about the changes in interest rates, speaking with a mortgage broker can help you make more informed decisions and help to keep your options open.

There are numerous factors which impact how much you can borrow for your mortgage.

You may be wondering how much you need to earn to get a mortgage. What many do not realise is that there are many other factors which impact your borrowing capacity on top of earnings. This includes your deposit, financial outgoings, credit history, type of mortgage and employment status.

To get a clearer idea on how much you could borrow, it is best to speak with an expert consultant. They will be able to offer personal guidance in the context of your financial and personal circumstances.

Important Information

The above calculations are only examples and are not guaranteed. Loans are subject to status and valuation and are not available to persons under 18 years of age. Written quotations available from individual lenders. For secured loans the lender will require a charge on your property and in the case of endowment mortgages, an endowment/life policy for the amount of the advance and a charge over the property. For interest only mortgages, the above calculations do not take into account the cost of any endowment, pension or other savings plan being used to repay the loan. In addition, the figures shown in respect of both repayment and interest only mortgages do not include the cost of additional life cover.