The Bank of England cut the base rate by 0.25% to 4.00% after a tight 5–4 vote from the Monetary Policy Committee (MPC). That’s a direct win for tracker borrowers. For fixed‑rate mortgages, pricing follows swap markets and lender funding rather than Bank Rate alone, but the cut has supported further modest tweaks lower.

Key borrower takeaways:

- On a tracker? Expect a 0.25% cut to your pay rate (timing per lender/product terms).

- On a Standard Variable Rate (SVR)? Some lenders may pass on part/all of the cut, but it’s discretionary — a good prompt to review options.

- On a fixed? Your payment doesn’t change, but new‑business fixed rates may continue to edge down as lenders reprice.

Why the tight 5-4 vote matters

Minutes show a knife‑edge decision and a second vote to break a 4–4 deadlock. That’s a reminder not to bank on a straight‑line fall in rates from here — plan for bumps.

Our guidance this week:

- Refinancing within 6 months? Secure a deal now and keep a switch‑down option in case pricing improves before completion. Read more information on refinancing here.

- Purchasing? Build a buffer in case your chosen lender reprices before exchange.

- Complex cases (buy-to-let, bonus income, contractors): expect slower pass‑through of improvements — careful packaging matters.

Where are mortgage rates now?

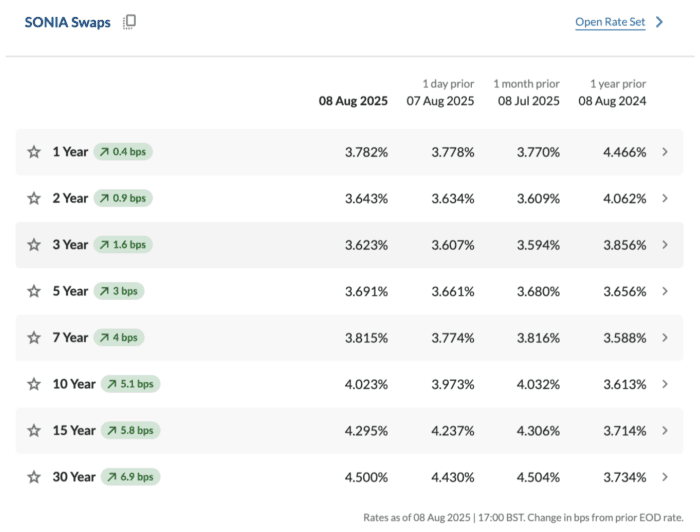

Swap rates influence mortgage rates because they reflect the cost for lenders to borrow money in the financial markets, so when swap rates rise or fall, lenders adjust mortgage rates accordingly to maintain profitability.

What this means for mortgages

- 2‑ & 3‑year fixes: Supported by lower short‑dated swaps. This explains why 2‑year deals are nudging below 5‑year averages again. Expect small, tactical trims rather than big moves.

- 5- & 10‑year fixes: The long end is higher than a year ago. Lenders may be cautious about deeper cuts here; pricing could be sticky unless global yields ease.

- Trackers/SVR: The base‑rate cut helps trackers directly, but fixed‑rate cuts depend on swaps, not Bank Rate alone.

Our take

- If your horizon is 2–3 years, a shorter fixed or tracker rate with fair early repayment charges (ERCs) could aid flexibility to refinance if pricing improves.

- If you want payment certainty for 5+ years, don’t wait for perfection: the 5–10 year swap zone isn’t clearly trending down; it may be wise to lock and keep your options open to switch to a lower rate later in case lenders reprice lower before completion.

Two‑year fixes just slipped under five‑year deals — why it matters now

Average 2‑year fixed mortgage rate has edged below the average 5‑year fixed mortgage rates. The gap is minimal (a few basis points), but symbolically important: it points to a gradual return to a more “normal” curve where short fixes are cheaper because you’re taking more near‑term rate risk.

What’s driving this change? The Bank of England’s move to cut Bank Rate to 4.00% has nudged down near‑term funding costs and encouraged lenders to sharpen headline pricing, especially at lower loan-to-values (LTVs). Markets are tentatively pricing in a gentle easing path ahead. That supports short‑dated swap rates more than the long end.

Who could benefit?

- Remortgagers within 6–9 months: a 2‑year fix regains appeal if you prefer the option to refinance sooner, should pricing improve.

- Movers with potential life changes (job, school catchments): shorter fixes reduce the risk of paying early‑repayment charges (ERCs) if plans change.

- Borrowers comfortable with some volatility in 2027–28: you’re trading long‑term certainty for flexibility.

What to watch out for:

- The gap is small — look at the true cost (rate + fees + incentives), not just the headline.

- If stability matters (single income, new baby, tight budget), a 5‑year may still be right even if it’s a touch pricier today.

- Lenders are repricing frequently following the MPC meeting; short‑notice withdrawals could occur while they manage pipelines.

If you would like to discuss your mortgage options with a qualified professional, you can speak to one of our mortgage advisors on 0800 980 8777, by emailing us at info@privatefinance.co.uk

This article is based on information available on the date of issue, 11th August 2025.

Disclaimer: The views and opinions expressed in this content are those of the author and do not constitute financial, legal, or professional advice, nor should they be interpreted as a recommendation. They do not necessarily reflect the official views, policies, or positions of Private Finance, and are not intended to represent broader market or industry perspectives.

Share this article: